Introduction

Taxable Income Calculation is a new screen designed for trusts to reconcile income for distribution. From this screen, users can update certain items in the calculation of taxable income not processed via transaction entries.

Navigation

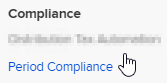

|

Navigate to Compliance from the Main toolbar |

|

|

Select Period Compliance |

|

Click on Calculate Taxable Income

The screen will present a breakdown of the taxable income calculation from transaction entries, with relevant tax labels attached.

Note

Users will not be able to change the Start Date/End Date as it is an annual calculation only. The period will default to the Current Financial Year.

Features

Users can add items for adjustments.

Step 1: Click on  from a section.

from a section.

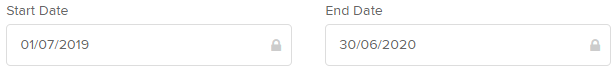

Step 2. Select an item from the drop-down lists.

Step 3. Update the amount.

Step 4: Select ![]() once completed.

once completed.

Items available to be added

- Forestry Managed Investment Scheme Deduction - 17D

- Non-Taxable Capital Gains Items - N/A

- Adjustment for Accrued Expenses - N/A

- Other Expense Reconciliation Adjustment

- Division 43 Write-Off For Capital Works

- Blackhole Expenses Deductible Under S.40-880

- Accounting Profit On Sale Of Depreciating Assets

- Psi Attributed To An Individual

- Other Exempt Income

- Increase In Value Of Stock For Accounting Purposes

- Deduction For Decline In Value Of Depreciating Assets

- Deductible Balancing Adjustment Amounts On Depreciating Assets

- Hire Purchase Agreements And Luxury Car Leases - Interest Components

- Decrease In Value Of Stock For Tax Purposes

- Prepaid Expenses Deductible In The Current Year

- Payment Of Annual Leave, Long Service Leave

- Borrowing Cost Deductible In The Current Year

-

Superannuation Contributions Accrued In A Prior Year But Not Paid In Current Year

-

Capital Works - 9X

- Selecting this option allows you to link capital works / allowance amounts to a specific property:

- Selecting this option allows you to link capital works / allowance amounts to a specific property:

- Tax Withheld where ABN not Quoted - 6T

- Credit for Tax Withheld - Foreign Resident - 6U

- Forestry Managed Investment Scheme Income - 10Q

- Adjustment for Accrued Revenue - N/A

- Other Income Reconciliation Adjustments

- Capital Expenditure

- Borrowing Cost Non-Deductible In Current Year

- Non-Deductible Donations

- Assessable Balancing Adjustment Amount On Depreciating Assets

- Bad Debts Recovered Not Included In The Financial Accounts

- Increase In The Value Of Stock For Tax Purposes

- Accounting Loss On Sale Of Depreciating Assets

- Additions To Provisions And Reserves

- Amortisation Of Intangible Assets

- Non-Deductible Expenses Relating To Psi

- Expenses Relating To Exempt Income

- Finance Lease Interest

- Hire Purchase And Luxury Car Lease Payments

- Decrease In Value Of Stock For Accounting Purposes

- Prepaid Expenses That Are Not Tax Deductible In Current Year

- Superannuation Expenses Accrued But Not Paid In The Current Year

- Landcare and Water Facility Tax Offset - 28G

- National Rental Affordability Tax Offsets - 51F

- Exploration Credits Distributed - 52G

- Early-stage Venture Capital Limited Partnership Tax Offset - 53H

- Early Stage Investor Tax Offset - 53I

Remove items

To remove an item added, select the cross icon beside the item.

To remove all items added, select Refresh to return to the original status.

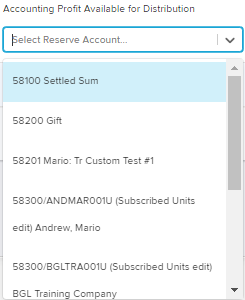

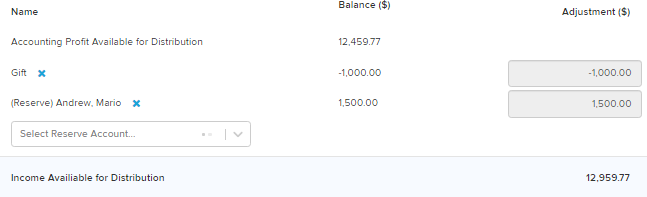

Select Reserve Account

A list of Reserve Account can be selected. Users can create new accounts from 58201 - 58299 code range as Reserve Account for selection.

Figures entered in the Reserve Section will affect the Income Available for Distribution.

To remove the allocation, select the x icon.

Alternatively, select Reverse Period from the Period Compliance screen to reset the selected financial year.

- Note: This will reverse any other changes entered in the Year-End process including any amounts entered in Step 2: Distribute Profit.

Note

The net amount of the Reserve Adjustment will be calculated and included as part of the Current year Accounting Profit/Loss and Share of Net Income Of Trust (W) label in the Tax components Section under the Distribute Profit (the second stage in the Year-end Workflow) tab.

Export to PDF or Excel

Export the Statement of Taxable Income by selecting Export to PDF or Export to Excel.