Support Query

How do I change an expense to non tax-deductible?

Solution

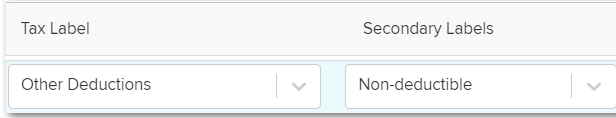

Transactions to Default expenses accounts where the Tax Label is set as Other Deductions and the Secondary Tax Label set as Non-Deductible will not be calculated as deductible in the tax return.

Note: Tax Labels only apply to Trusts and Companies. For more information, see:

Not all expenses can be made non-deductible. However, tax labels can be changed for custom account types.

You can add new expense accounts as Other Accounts in the Chart of Accounts. Expense accounts appear in the 30000 and 40000 account ranges.

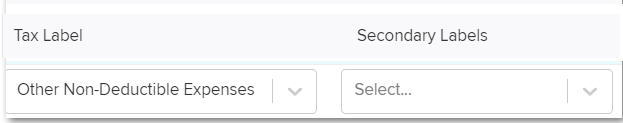

When posting to Custom expense accounts, select Other Non-Deductible Expense as the Tax Label.

The Secondary Tax Label can be selected if required, though this part is not necessary for the purpose of recording the expense as Non-Tax-Deductible.